Equity Crowdfunding

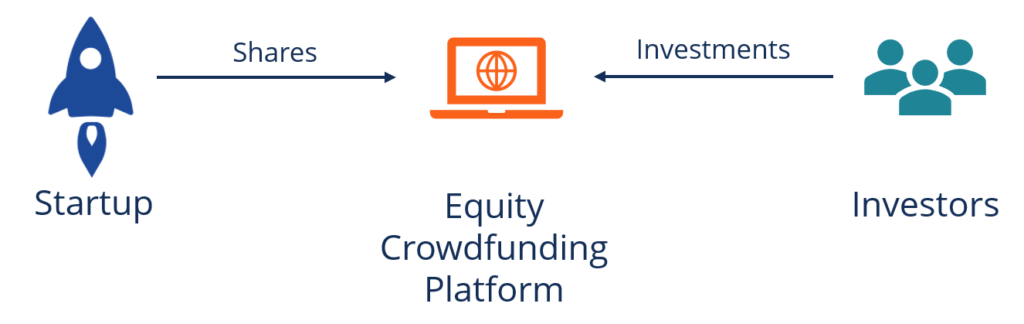

Equity crowdfunding (also known as crowd-investing or investment crowdfunding) is a method of raising capital used by startups and early-stage companies. Essentially, equity crowdfunding offers the company’s securities to a number of potential investors in exchange for financing. Each investor is entitled to a stake in the company proportional to their investment.

Equity crowdfunding is quite different from other crowdfunding methods such as rewards crowdfunding and donation crowdfunding. The model provides a more conventional capital-raising method by offering financial securities to investors.

The crowdfunding process is carried out on specialized online platforms such as Wefunder and StartEngine. The digital nature of the crowdfunding platform fosters a more liberal and open way of financing.

Unlike conventional capital-raising methods for early-stage companies, which primarily rely on investments from a small group of professional investors, equity crowdfunding targets a broader group of investors. The main idea of equity crowdfunding is to raise the required capital by obtaining small contributions from a large number of investors.

Benefits of Equity Crowdfunding

Equity crowdfunding introduces a new approach to the investing and capital-raising process. It can offer several benefits to both companies and investors.

1. Easier access to capital

Online crowdfunding platforms allow entrepreneurs and companies to showcase their projects to a larger number of potential investors, as compared to conventional forms of capital raising.

2. Less pressure on the management

Unlike the conventional forms of financing, such as venture capital, equity crowdfunding does not result in a dilution of power within a company. Although the number of shares is increased, the involvement of a large number of investors means that power is not concentrated around a particular group of shareholders.

3. Lucrative returns

Although startups are inherently risky ventures, there is still a possibility that a company may become a unicorn and provide very lucrative returns to the investors.

Risks with Equity Crowdfunding

Any party that is willing to participate in equity crowdfunding must be aware of the risks that are associated with it. Some of these risks include the following:

1. Equity dilution

Since equity crowdfunding is related to the issuance of new shares, the stake of current shareholders will be diluted. (Although, as noted above, share dilution does not usually have the same effect as it does in more traditional financing scenarios.)

2. High risk of failure

As mentioned above, startups are extremely risky ventures. Therefore, there is a high likelihood that the company will fail.

3. Low liquidity

Potential investors should be aware that securities purchased on equity crowdfunding platforms are highly illiquid. Thus, exit options are limited or may not even realistically exist. Just as is the case for traditional venture capital investors, crowdfunding investors may have to wait several years for their investment to pay off.

4. Risk of fraud

Investors must also be wary of potential fraud schemes in the equity crowdfunding process. Fraudsters may use asymmetric information, as well as the loopholes in regulations, to deceive investors. However, the crowdfunding platform companies work diligently to verify the information provided by companies seeking capital funding.

Regulations

Equity crowdfunding is still a new phenomenon, only emerging since the turn of the century. Hence, some countries have only recently passed regulations regarding such fundraising methods, while other countries implement only loose, generic regulations.

One of the major goals of regulation is the protection of investors, because the fundraising model is potentially prone to fraud.

The biggest leap for equity crowdfunding regulation occurred in the United States with the introduction of the Jumpstart Our Business (JOBS) Act in 2012. The law allows the participation of both accredited and non-accredited investors in equity crowdfunding. Also, the act establishes limitations on the amount of funds that can be raised by companies, as well as on the amount that can be invested by each investor.

We can help you find the best equity crowdfunding platform for your innovation project and startup company.

Contact us for more details.